Facilitated Membership

Facilitated Membership is an ASX service model option available for firms who are seeking membership of ASX Clear (Futures). It provides these firms with the option to use a third party service model to provide the technology and operational support to connect to the clearing house.

Further details regarding Facilitated Membership can be found here.

ASX Clear (Futures) - Client Clearing

Under regulation from ASIC and the RBA, and after working in consultation with the Australian market place, ASX introduced the OTC Client Clearing service in April 2014, and the Futures Client Clearing service in July 2014. The two services combine to provide a world class central clearing service for OTC Interest Rate Derivatives and ASX24 ETD contracts, under the existing ASX Clear (Futures) Clearing and Settlement facility licence.

The website for the ASX OTC Clearing service can be found here.

Client Protection

The ASX Client Clearing Service established an account structure and set of governing rules, that enables its Participants to offer to their futures and OTC Derivative customers the choice of clearing through an Individual Client Account or a traditional Client Omnibus account.

The Individual Client Account (ICA) is opened in the name of the individual client at ASX, under the Client clearing account of the Clearing Participant (who continues to clear transactions as an agent of the Client). The segregated account allows for the separate identification and protection of individual customers’ gross positions and Collateral Value. Collateral Value is the higher of the initial margin value of positions in the ICA, or the total collateral (cash and non-cash) which has been attributed (via the CP) to the ICA account, including excess collateral.

The ICA significantly increases the likelihood of ASX being able to port an individual client’s positions and Collateral Value, to a nominated Alternate Clearer, in the event of Clearing Participant default. Where porting is not available, ASX will close-out the positions in the ICA, with margin value and/or actual attributed assets being returned directly to the client (less the costs of close-out).

The ASX Client Protection Model governs the contractual relationship between ASX, the Clearing Participant and the CPM Client (in an ICA), and also governs the procedures undertaken in the event of Clearing Participant default.

Further details regarding the ASX Client Clearing Service (including links to the Client Fact Sheets) can be found here.

Customer Benefits

ASX Clear (Futures) services are provided to clearing participants who are typically brokers or clearing and custody service providers. The two key benefits to clearing participants are netting efficiencies and counterparty credit protection.

Netting Efficiencies

ASX Clear is approved as a ‘netting market’ for the purposes of the Payment Systems and Netting Act. This enables the netting of settlement obligations in each individual equity providing greater market efficiency at the time of settlement and reducing participant transaction and funding costs.

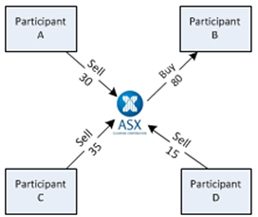

The left-hand diagram below depicts participant A’s trading activity in a single product. At a gross level, participant A has sold 100 contracts to, and bought 50 contracts from, participant B. Participant A has also sold 30 contracts to, and bought 50 contracts from, participant C. Post novation, participant A’s trades with participants B and C are replaced with trades between participant A and ASX Clear (Futures). Post netting this becomes a net sale of 30 contracts from participant A to ASX Clear (Futures) (right-hand diagram).

.jpg)